Blog · Approx. 9 minute read

The B2B Payments Landscape Today

The business-to-business (B2B) payments landscape is changing rapidly.

Payments pioneers, like Amazon and Venmo, have set the standard. Now B2B buyers seek the simple purchasing experience that consumer payments give them.

Some traditional payment methods are still popular. But most businesses now need to accept payments from multiple methods to keep up with customer expectations.

So, which B2B payment types are available today? And which ones are the most popular?

Let’s look at the current state of B2B payment models and what the future likely holds for this field.

Overview of the B2B payments landscape

B2B payments are payments made by a corporate buyer to a merchant for products or services.

They have traditionally been more complex than business-to-consumer (B2C) or P2P (peer-to-peer) payments. This is for a number of reasons, including:

- B2B buyers prefer purchasing on net terms. This increases the administrative workload for both merchants and buyers.

- Cross-border B2B purchasing increases complexity. Multiple currencies and tax regulations are involved.

- Continued use of paper checks and manual processes. These are slower and more labor-intensive than digital payment solutions.

Reducing administrative costs (and paper)

In recent years, businesses have accelerated their migration toward automated B2B payment solutions to reduce administrative work and costs.

The average U.S. business using paper-based payment processes could have as much as 24% of its working capital tied up in net terms. And nearly half (49%) of invoices generated by U.S. businesses are paid late – this takes up the accounts receivables department’s time and some become uncollectible.

Using an automated payment system can reduce manual processes, labor costs, and paper wastage!

Why are B2B payment trends going digital?

Efficiency and cost are perennial concerns for AR and finance teams along with B2B payments. Part of the move to digital is the increasing pressure on credit departments in enterprise organizations to lend wisely.

Chief financial officers (CFOs) and treasurers are also under pressure to refine and improve cash flow management practices, reduce unpaid invoice write-offs, and streamline workflows.

Other factors have come into play as well, including the following:

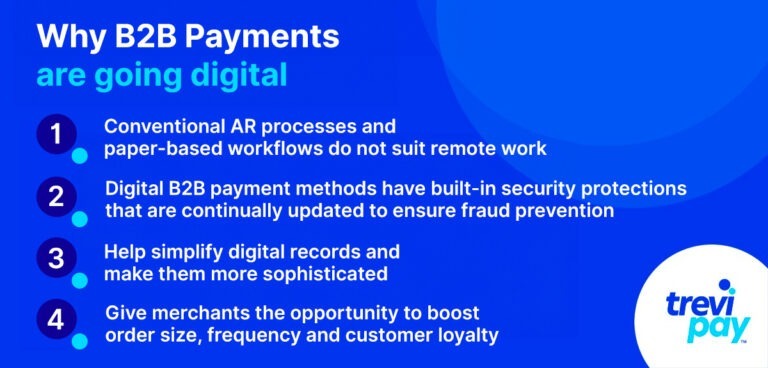

1. Remote work

The need to improve accounts receivables (AR) performance when work is done remotely has been a significant driver of digital B2B payments’ evolution.

Conventional AR processes and paper-based workflows do not suit remote work. As a result, organizations that still rely on them can experience delayed payments, payment delays and errors.

2. Fraud prevention

Secure electronic payments are especially important with B2B payments because of the large transactions involved. Invoice and payment fraud is another reason for businesses to consider digital B2B payment methods.

They often have built-in security protections that are continually being updated to combat cyber theft.

3. Financial data

Online B2B payment solutions can often help to both simplify your digital records and make them more sophisticated. They do this by centralizing transaction data for quick access and analysis and minimizing manual processing errors.

It benefits businesses in multiple ways, one of which is simplifying the review of customer data through digital solutions’ formatting and inherent search functions.

Tax preparation benefits from these platforms, too. They often provide automated summaries, making it easier to track expenses, maintain digital invoices, and streamline the auditing process.

In essence, digital B2B systems not only simplify administrative tasks but also boost accuracy and strategic decision-making for businesses.

4. Improved B2B eCommerce sales

More purchasing options often mean more purchases on B2B eCommerce websites and B2B-specialist marketplaces.

When incorporated with net terms at the point of order, they also give merchants the opportunity to boost order size and frequency as well as overall customer loyalty.

The most common B2B payment methods in 2023

Most B2B payment processing is still done by conventional methods. But B2B payment trends are steadily moving toward digital and automated payment models. The ability to offer customers their preferred payment method is essential.

Which type of electronic payment is typically favored for B2B payments? Commonly used types of both conventional and electronic methods include the following:

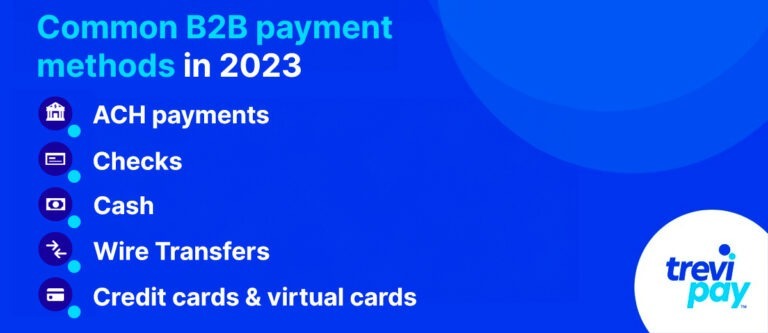

Automated clearing house (ACH) payments

Automated clearing house (ACH) payments enable businesses to transfer funds electronically to other businesses using the Automated Clearing House Network. The market for them grew by 6.6% back in 2022.

It is an established technology that some have seen as a safe entry into electronic B2B payments for direct deposit and direct debits. However, it requires more time and administrative steps than some of the real-time payment models recently introduced.

Funds transferred via ACH are typically not available for two to three business days. So it’s likely that many businesses will bypass ACH and transition directly to newer B2B payment models.

Checks

Checks (often spelled cheques outside of the US) are still popular in the B2B world. However, as with most paper-based processes, their use is projected to decline.

73% of businesses surveyed in one study are in the process of transitioning B2B payments from checks to electronic payments.

Part of the reason is the expense. The same survey indicates that it costs businesses $1 to $2 to receive a check.

And as a B2B payment method, checks are too slow and too prone to errors and fraud to suit the future needs of enterprise organizations.

Cash

With the exception of businesses in a few select emerging markets, cash is rarely used as a B2B payment method anymore.

It may reduce transaction fees but it carries a risk of theft and a high administrative burden in terms of record-keeping. And buyers and merchants need to be located in close proximity for cash to be a viable payment method. This rules out most online and cross-border payments.

Wire transfers

A wire transfer is a transfer of funds from one bank account to account, so the funds are available immediately, and often the same day, but for a fee.

They currently account for about 10% of B2B payment types and are expected to continue at that level for the next few years.

They can be used for both domestic and global transactions. This makes them ideal for one-time or infrequent cross-border B2B payments (doing them repeatedly can lead to high processing costs).

Credit cards and virtual cards

48% of businesses surveyed in one recent study use credit card payments for B2B transactions. They have the same reasons as consumers do. Namely, credit and debit cards:

- Are convenient

- Provide rebates

- Have payment fraud protection

- Don’t require immediate payment

However, credit card payments often come with fees, especially for international purchases.

Virtual cards are used like credit cards, but they only exist online – there is no physical card.

The online-only aspect is a barrier for some companies. The inability of their current financial systems to handle virtual cards is one of the main reasons companies don’t adopt them.

Financing’s role in today’s B2B payments landscape

Innovative solutions for B2B financing and digital payments are now playing an increasingly large role in the B2B payments space.

The recent rise of non-traditional financial institutions has reshaped the business financing landscape. While banks still dominate, the alternative lenders’ market was valued at USD 10 billion in 2022. It is estimated to have a compound annual growth rate of 15% over the coming decade.

The key benefits of alternative lenders over traditional banks are:

- Access: They often require less documentation and requirements, resulting in higher approval rates. In January 2022, while big banks approved 14.5% of loans and small banks 20.3%, alternative lenders boasted a 26.3% approval rate.

- Speed: Thanks to technological innovations, decisions are made swiftly. For instance, TreviPay’s B2B payments platform can determine credit lines up to USD $250,000 within 30 seconds.

- Flexibility: The fintech market, with a predicted CAGR of 26.87% up to 2026, continuously innovates, leading to flexible payment terms and improved technologies.

Various B2B financing types include business loans, B2B trade credit financing, invoice financing solutions, venture debt for high-growth startups, and Net 30 terms, and more.

Embedded financing

Embedded B2B financing is becoming increasingly popular. This is because it provides seamless payment processes, which enhances the user experience.

It also allows non-financial entities to offer financing directly to business entities, simplifying the transaction process for businesses.

The future of B2B payment processing

Conventional B2B payment methods like ACH, checks, and credit cards are likely to decline in the coming years.

Innovative B2B payments solutions are increasingly integrating the best of B2C payment models with the specific needs of B2B business transactions, i.e., simple, fast, and convenient payments. These include:

- Extending B2B trade credit

- Decreasing companies’ days sales outstanding (DSO)

- Increasing efficiency in cross-border purchasing

Furthermore, the rise in B2B eCommerce, including the growth of the B2B marketplace field, is making the online payments space more important. This will likely further accelerate the decline of cash and paper checks and the growth of digital payment solutions.

Some enterprises are already using new types of B2B automated payment systems to accelerate growth and reduce costs.

In the long run, we might eventually see unified forms of business payment practices. However, in the short to medium-term, new B2B payments trends are continually appearing and the need to offer multiple payment methods likely will, too.

TreviPay’s B2B payments solutions

By offering trade credit and net terms via TreviPay’s B2B platform, B2B retailers can enhance customer spend and loyalty.

Our solution boasts of easy integration with its simple, well-documented APIs. Each one connects seamlessly with your eCommerce platforms, accounting software, or payment gateways.

And it supports omnichannel sales, accommodating eCommerce, marketplaces, offline sales, and in-store mobile payments.

It does this while supporting a cohesive purchasing experience for business buyers, with features like line-item SKU-level data and parent/child invoicing. And while maintaining brand consistency throughout the B2B buyers journey, from payment method branding to all customer communications.

Conclusion

The evolution of the B2B payments landscape is largely being driven by consumer expectations.

Traditionally, B2B payments were complex due to factors like cross-border complications, preference for net terms, and the use of paper checks. But in recent years, a shift towards multiple payment methods and online payments has gained momentum.

Key drivers for this shift include the demand for remote work adaptability, the need for fraud prevention, the emphasis on financial data analysis, and the growing importance of B2B eCommerce channels.

As of 2023, while conventional methods like checks and ACH remain dominant, their prominence is waning. Many businesses are migrating from checks to e-payments, and innovations in payment solutions are integrating user-friendly B2C features into B2B.

Also, alternative lending institutions and embedded B2B financing further simplify lending and transactions by seamlessly integrating financing into the payment process.

Moving forward, the B2B payments sphere is expected to increasingly mirror the simplicity, speed, and convenience of B2C models. It will likely do this while addressing B2B-specific needs, marking a transformative era for businesses globally.

Stay up-to-date with the latest from TreviPay

Thank you for subscribing! You will now receive email updates from TreviPay.