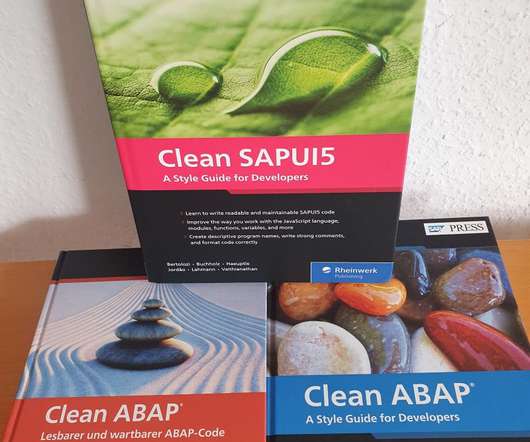

Clean Code: Writing maintainable, readable and testable code

SAP Credit Management

DECEMBER 21, 2022

Clean code is a term used to describe software that is easy to read, understand, maintain and test. In this blog I want to summarize some important principles, provide an entry into the topic for beginners. Besides, the blog shall connect to the style guide repository, the books and current initiatives where experts can contribute. If you do not want to miss an update on clean code, test automation, code reviews, unit testing, decision making, testability and other engineering / craftsmanship /

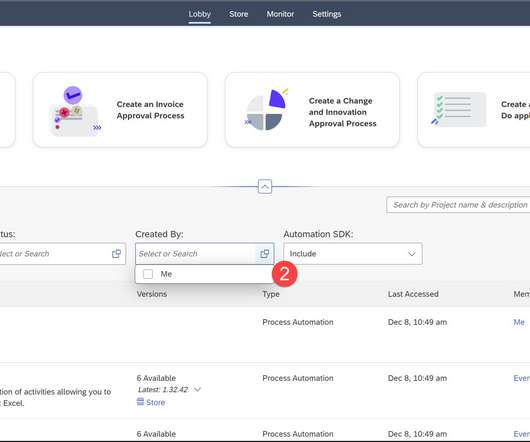

Let's personalize your content