Effective Strategies to Reduce Debtor Days

Efficient management of debtor days is crucial for businesses seeking to maintain a healthy cashflow.

By implementing effective strategies to reduce debtor days, you can enhance your business’s financial stability and improve overall profitability.

In this article, we’ll outline 15 actionable steps that can help you significantly reduce debtor days and optimise your cashflow!

Evaluate and improve your credit terms

Begin by assessing your current credit terms and ensure they are reasonable and aligned with industry standards.

Consider shortening the credit period, tightening credit limits, or implementing stricter credit approval processes. This helps reduce the time it takes to receive payments.

Conduct thorough business credit checks

Perform comprehensive business credit checks on new customers to evaluate their creditworthiness.

Review their payment history, financial stability, and credit references to make informed decisions about extending credit.

This step minimises the risk of dealing with customers who may have difficulty settling their debts.

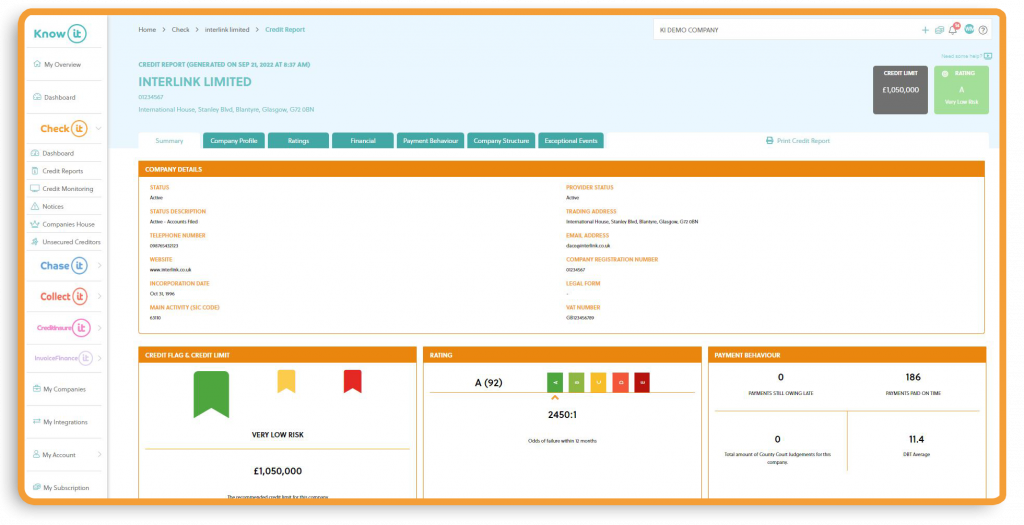

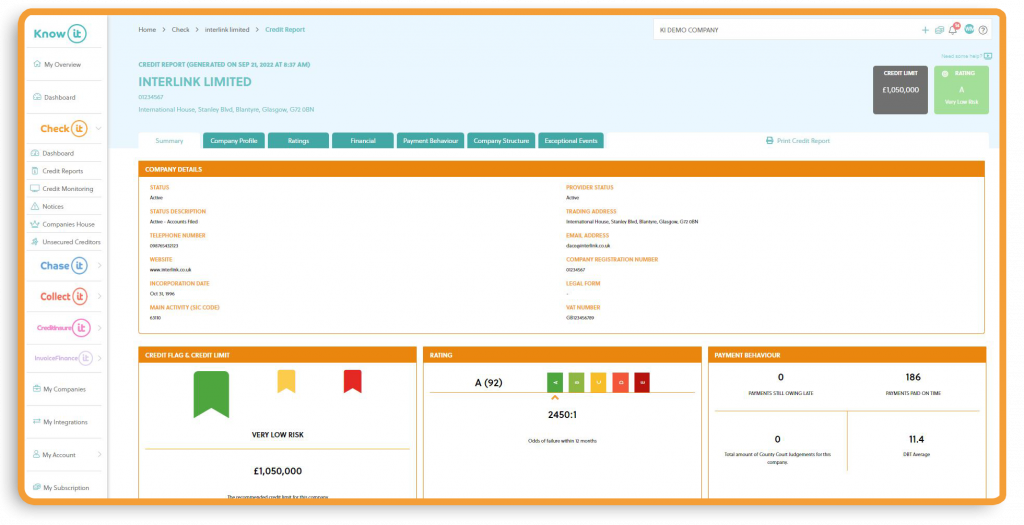

Check-it business credit reports are powered by Creditsafe!

You’ll clearly see:

- Credit rating

- Credit score

- Credit limit

- Company financials

- Track record of recent payments and any defaults

- CCJs

- Exceptional Events

Plus, you’ll also have access to Unsecured Creditor Claims data, information not included in standard business credit reports. This gives you insight into losses suffered by a company as a result of their customers going into liquidation or administration!

Check out our complete guide to reading a business credit report!

Establish clear credit policies

Develop clear and concise credit policies that outline payment terms, penalties for late payments, and the process for resolving payment disputes.

Communicate these policies to your customers and ensure they are consistently applied. Clear policies set expectations and encourage timely payments.

Adding late payment interest to your unpaid invoices serves as an incentive for payment to be made promptly, so we would always recommend including this in your credit policies!

Implement proactive invoicing practices

Send out invoices promptly after delivering goods or services.

Include clear payment terms, due dates, and payment methods on the invoices.

Utilising electronic invoicing systems can streamline the process and reduce delays, ensuring your customers are aware of their payment obligations.

Offer discounts for early payments

Motivate customers to settle their invoices promptly by offering early payment discounts.

This incentive encourages timely payments and can significantly reduce debtor days while also strengthening customer relationships.

Follow up on overdue payments

Establish a systematic process for following up on overdue payments.

Send polite reminders, make phone calls, and escalate the matter if necessary.

Ensure you have a dedicated team or individual responsible for debt collection, maintaining regular communication with customers, and resolving payment issues.

Struggling for time? Automatically schedule payment reminders and chasers to send via email, SMS and letters with Chase-it!

Negotiate payment plans

If a customer is facing financial difficulties, consider negotiating a payment plan that allows them to settle their debts over a specified period.

Finding a mutually beneficial arrangement can ensure you receive payments while maintaining a positive business relationship.

Often it is worth recovering amounts owed in instalments rather than completely losing out.

Strengthen communication channels

Enhance communication channels with your customers to address any issues or concerns promptly.

Encourage feedback on the payment experience and actively seek ways to improve your invoicing and payment processes.

Open lines of communication foster transparency and help resolve potential obstacles to timely payments.

Utilise technology and automation

Implement accounting software to automate invoicing, payment reminders, and payment tracking. These tools streamline processes, reduce errors, and improve overall efficiency, enabling faster and more accurate credit management.

Know-it seamlessly connects with Xero, Sage, QuickBooks and FreeAgent which allows you to automate the complete credit control process, helping you mitigate credit risk, reduce debtor days and boost cashflow!

Offer multiple payment options

Provide customers with various payment options, such as credit cards, electronic funds transfers and online payment platforms.

Offering flexibility in payment methods makes it easier for customers to settle their invoices promptly, reducing debtor days.

Monitor and analyse debtor days

Continuously monitor and analyse your debtor days to identify trends and areas for improvement.

Regularly review key performance indicators (KPIs) related to accounts receivable, such as average collection period, aging analysis, and bad debt ratio.

This data helps you track progress and make informed decisions.

Strengthen relationships with key customers

Develop strong relationships with key customers by providing exceptional customer service, offering personalised solutions, and understanding their specific needs.

Loyal customers are more likely to prioritise timely payments, helping to reduce debtor days.

Review terms with suppliers

Consider negotiating extended payment terms with your suppliers to align them better with your customers’ payment cycles. This approach reduces the strain on your cashflow and provides more flexibility when managing debtor days.

Train and educate your team

Provide training to your staff members responsible for invoicing, accounts receivable, and debt collection.

Ensure they have the necessary skills and knowledge to handle customer interactions effectively and resolve payment issues efficiently.

Well-trained employees contribute to a streamlined credit control process.

Continuously optimise your processes

Regularly review and refine your credit management processes based on feedback received and lessons learned.

Embrace a culture of continuous improvement to adapt to changing market conditions and customer demands.

Ongoing optimisation ensures the sustainability of your efforts to reduce debtor days.

Conclusion

By implementing these 15 strategies, you can significantly reduce debtor days in your business, leading to improved cashflow and financial stability.

Remember, consistent implementation, monitoring, and a customer-centric approach are vital for achieving sustainable results.

Embrace these strategies, adapt them to your business’s unique needs, and enjoy the benefits of a streamlined and efficient credit management system!

Save time and reduce your debtor days more efficiently

Know-it automates the complete credit control process, saving you time whilst mitigating credit risk, reducing debtor days and boosting cashflow!

Best of all, it’s free to get started!

Get started and get a free business credit report today.

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!