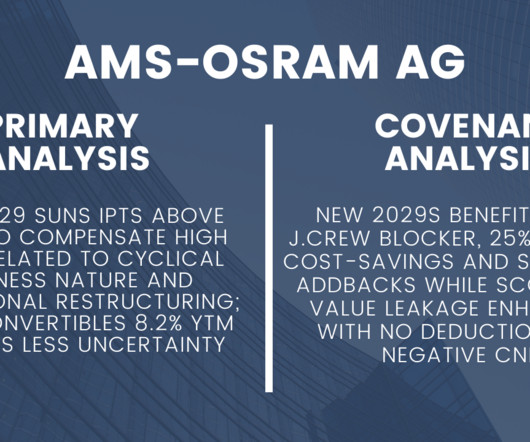

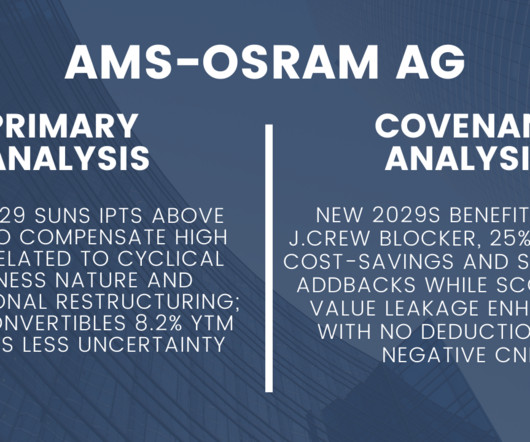

Primary Analysis: Ams-Osram New 2029 SUNs IPTs Above Peers

Reorg Blog

NOVEMBER 15, 2023

Ams-Osram AG, is marketing $800 million-equivalent senior unsecured notes due 2029, as a part of its pre-communicated holistic €2.25 billion financing plan. The new notes will be split between a euro-denominated and dollar-denominated tranche based on demand.

Let's personalize your content