Resolve to Be More Proactive in 2024

Your Virtual Credit Manager

JANUARY 9, 2024

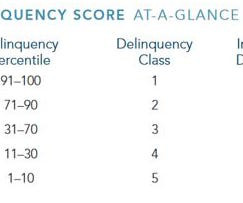

Segmenting your receivables can be based on any number of criteria: industry type, distribution channel, customer risk rating or score, credit limit, AR aging and so on. While these are all useful as a secondary segmentation, the place you want to start is with customer annual purchases from your firm.

Let's personalize your content