Cash Forecasting: More Important Than Ever

Your Virtual Credit Manager

MAY 9, 2023

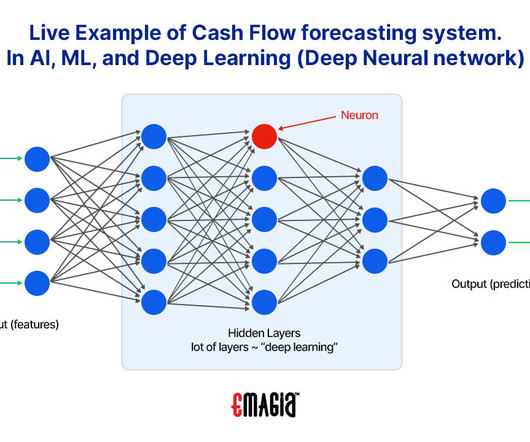

Photo by petr sidorov on Unsplash Cash forecasting is very important in “normal” economic conditions. Subscribe now How Cash Forecasting Is Done Cash forecasting is the process used for projecting how much cash you will have on hand in the future. Conceptually, cash forecasting is simple.

Let's personalize your content