The top lending & credit risk blogs of the year

Abrigo

DECEMBER 22, 2023

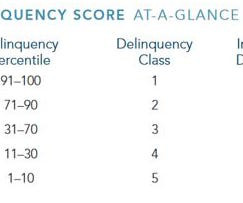

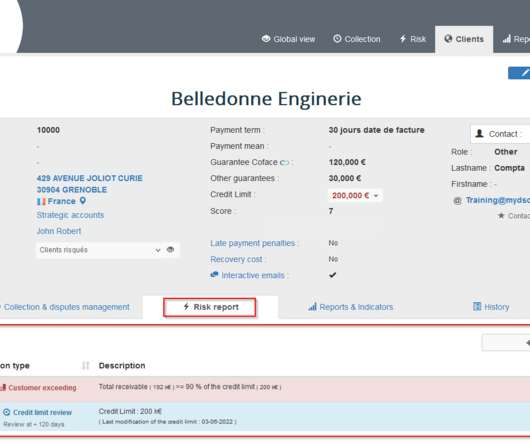

Those priorities are apparent in the most popular Abrigo lending and credit blog posts for the year. Articles on creating a sound credit risk rating system and preparing for the possibility of new requirements such as the CFPB ruling were among the most-viewed throughout the year. Read the buyer's guide to lending solutions.

Let's personalize your content