Gleaning Actionable Insights from Credit Scores

Your Virtual Credit Manager

APRIL 2, 2024

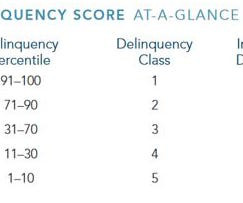

As such, they are just one of the many tools, such as credit reports, supplier and bank references, and financial statement analysis, that can help assess a business's creditworthiness. Commercial credit scores are often not as well understood as consumer credit scores such as FICO.

Let's personalize your content