Are There Hidden Risks in Your AR Portfolio?

Your Virtual Credit Manager

MARCH 26, 2024

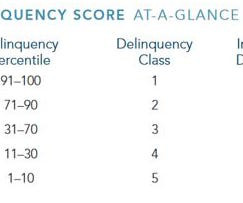

Economic circumstances may prompt a vendor to either tighten or loosen its credit policies and customer credit limits. Going beyond the impact of macroeconomic trends, a company’s customers operate in dynamic business environments, and for a majority of them, the credit risk they pose is either increasing or decreasing.

Let's personalize your content