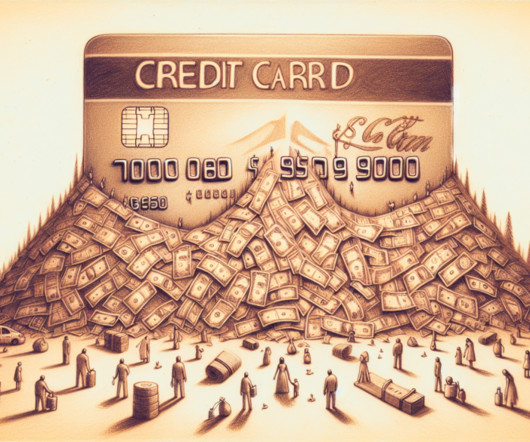

The Minimum Credit Score for a VA Loan

CreditStrong for Business

APRIL 3, 2023

However, qualifying members still need to meet specific credit requirements to get approval from a VA loan officer. Here’s what you should know about the minimum credit score for a VA loan. What is the Minimum Credit Score Requirement for a VA Loan? That often includes a minimum credit score.

Let's personalize your content