Four Goals Guaranteed to Improve Cash Flow

Your Virtual Credit Manager

DECEMBER 19, 2023

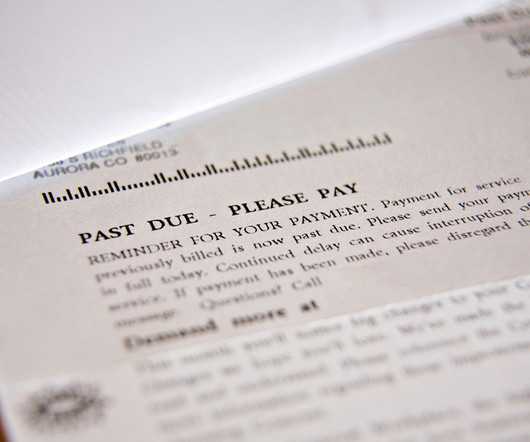

Hopefully, that is why you are reading Your Virtual Credit Manager. If your AR has a sizable balance over 90 days past due, you should make it a top priority to make your final calls, send the final demand letters, and if necessary refer the account to a third party collection agent.

Let's personalize your content