Form 8829 Instructions: Claim Home Office Deduction

Fundera

MAY 14, 2020

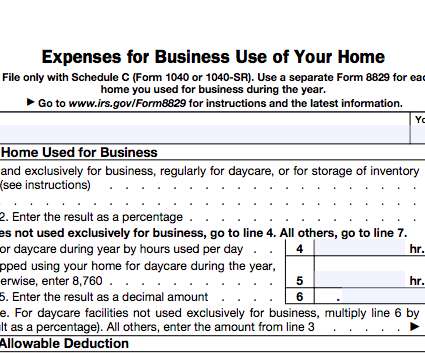

IRS Form 8829 is one of two ways to claim a home office deduction on your business taxes. Only self-employed people are eligible to claim this deduction. If your business qualifies for the home office deduction, you’ll file Form 8829 with your Schedule C, profit or loss from business. IRS Form 8829.

Let's personalize your content