Small Businesses + Small Banks = Big Success

Fundera

MARCH 8, 2016

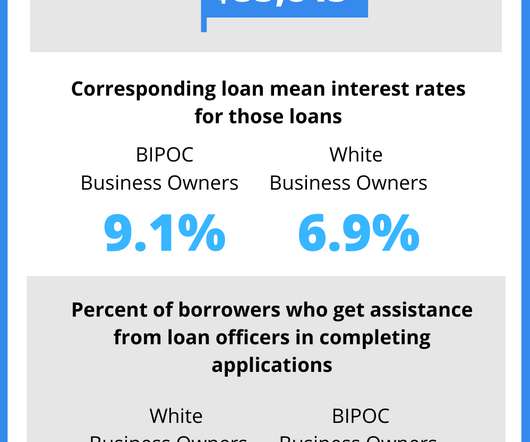

Younger, smaller businesses tend to have more trouble finding business loans from banks, which accounts for the accompanying increase in credit unions and especially online lenders. . With over half of all credit applications heading towards small banks, they clearly have an immense influence on lending in the United States.

Let's personalize your content