The 10 Best Freelancer Tax Deductions

Fundera

MARCH 11, 2020

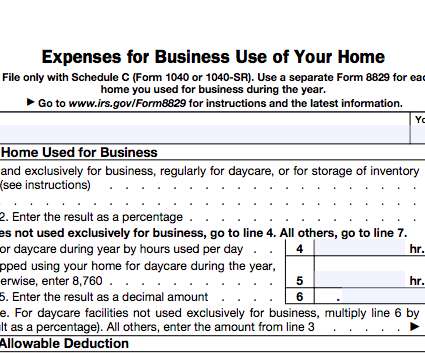

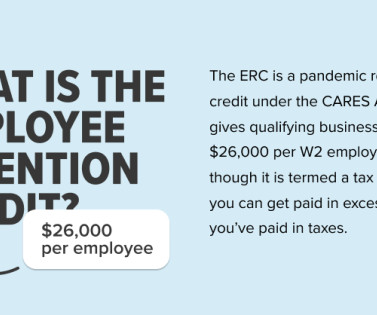

And then, there are freelancer tax deductions that you can take. What can you deduct and where do you deduct it? This guide walks you through some of the deductions you might qualify for, why they’re so valuable, and some tips for how to keep track of them. . What Are Freelancer Tax Deductions?

Let's personalize your content