Small business lending insights Vol. 1

Abrigo

APRIL 25, 2024

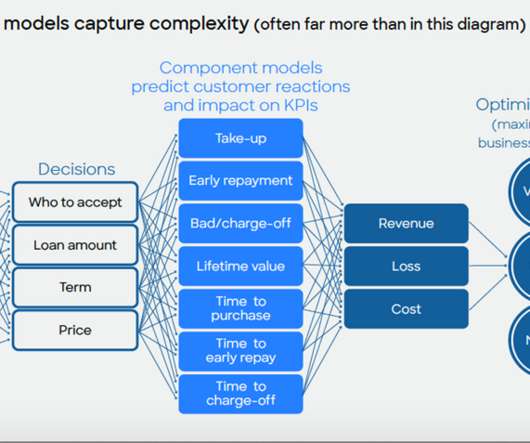

Takeaway 3 With lower interest rates nowhere in sight, lenders need to monitor and adjust lending and underwriting strategies based on their own institution’s credit risk profile. At the same time, 59% pursued credit to meet operating expenses. A majority of applicants sought less than $100,000. 1 appeared first on Abrigo.

Let's personalize your content