Majority of Business Owners Say PPP Wasn’t Enough, and They’d Apply for More Help: Survey

Fundera

JULY 24, 2020

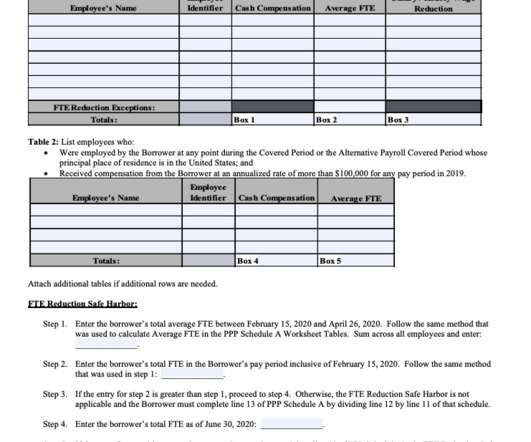

A new survey of business owners from Fundera shows that a majority feel the first round of financing from the Paycheck Protection Program (PPP) wasn’t sufficient to help them cover costs, and that they would apply for a second round of federal financing if it becomes available. . 5 Big Takeaways From Fundera’s PPP Survey.

Let's personalize your content