Gleaning Actionable Insights from Credit Scores

Your Virtual Credit Manager

APRIL 2, 2024

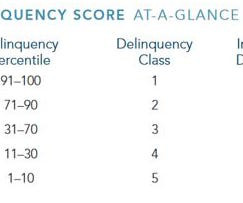

Still others may be predictive of default, financial distress or financial health, and creditworthiness. While credit scores will not always predict the expected result, they are statistically correlated to predict a much higher occurrence of a given outcome (e.g., delinquency or default) than will be found in a random sample.

Let's personalize your content