What are the Benefits of our Credit Management Support Service?

Credit Management Group UK

JANUARY 7, 2024

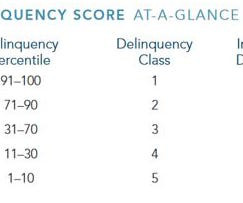

Have you ever had to write of a bad debt? Have you ever put off taking action on a debt, due to uncertainty? We also include credit risk reporting of your current and prospective customers, as well as monitoring said customers for changes in their credit risk. Do you find it difficult to get paid on time?

Let's personalize your content