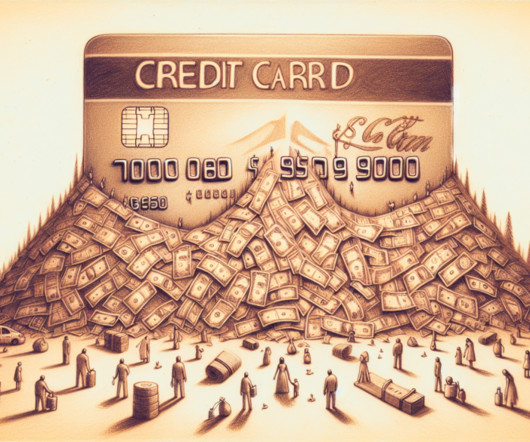

Due Diligence Doesn't End with the Credit Application

Your Virtual Credit Manager

JANUARY 23, 2024

Among other things, commercial bankruptcies have been steadily climbing over the past year. If the European parent company defaulted, the North American subsidiary would be pulled into bankruptcy even though its operations were profitable. request for substantially more credit, change in leadership, merger or acquisitions, etc.).

Let's personalize your content