What Happens When You Default on a Loan? This Will Explain All

Fundera

AUGUST 11, 2016

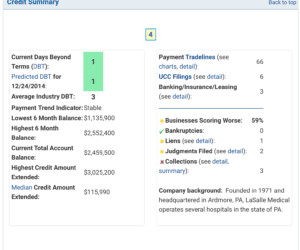

What happens when you default on a loan? What Happens When You Default on a Loan? As soon as your loan is considered in default, the lender will contact you. The more payments you miss, the more damage will be done to your credit score. So, let’s learn what happens when you default on a loan of every time.

Let's personalize your content