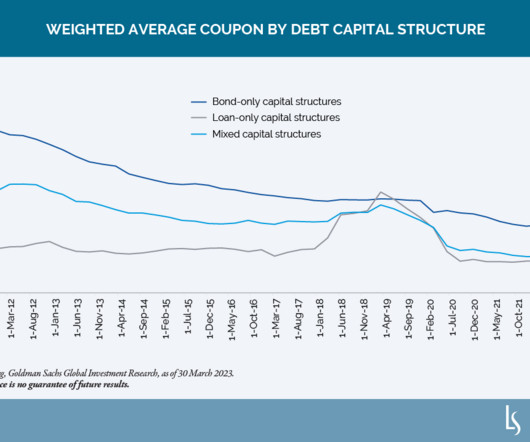

Capital Structures and Rising Debt Costs: How Concerned Should You Be?

Loomis Sayles Credit Research

MAY 15, 2023

Interest costs have risen sharply with interest rates, sparking speculation about whether companies with loan-only capital structures might be more vulnerable than their peers in the leveraged loan market. We believe limiting accusations of deteriorating debt service capacity to companies with loan-only structures is unfair.

Let's personalize your content