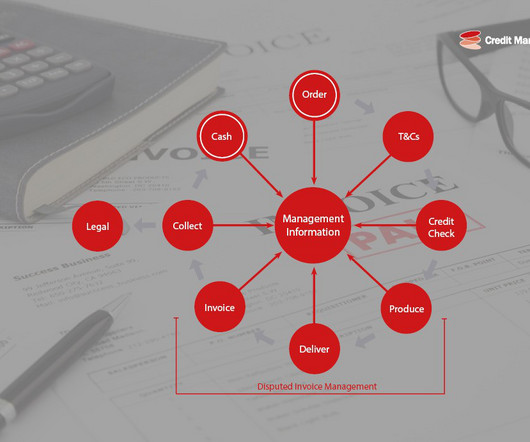

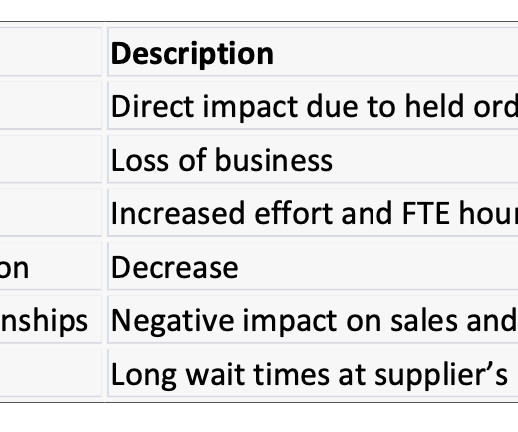

“Must Have” Metrics for Receivables Management

Your Virtual Credit Manager

MAY 14, 2024

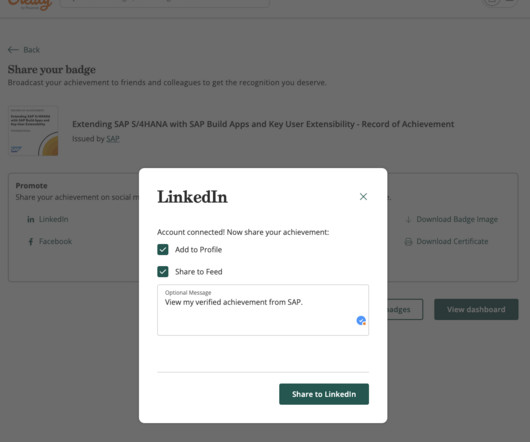

If conditions are satisfactory and all your credit and collection assignments have been completed, you can then address the many other tasks and challenges requiring your attention. Do you need help collecting past due receivables or understanding your customer portfolio risks? it just might help them collect faster and pay you sooner.

Let's personalize your content