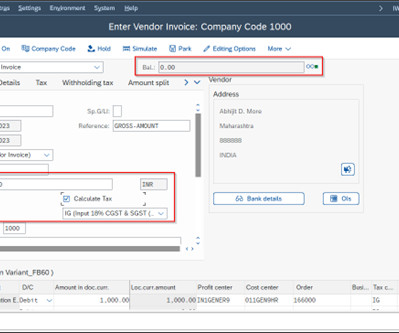

Tax calculation on Net or Gross invoice amount.

SAP Credit Management

SEPTEMBER 4, 2023

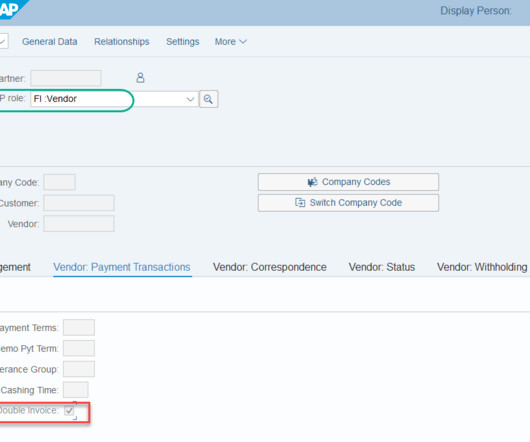

Introduction: In SAP, when we book a Vendor/Customer invoice it is up to the business requirement that how business wants to calculate the Tax amount it can be either on the gross amount or the net invoice amount. Step 1: Go to T-code: FB00.

Let's personalize your content