Silicon Valley Bank’s Downfall: A Warning for Regional Banks

Due

FEBRUARY 5, 2024

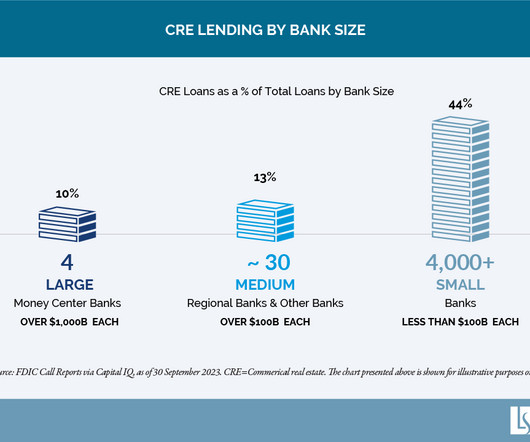

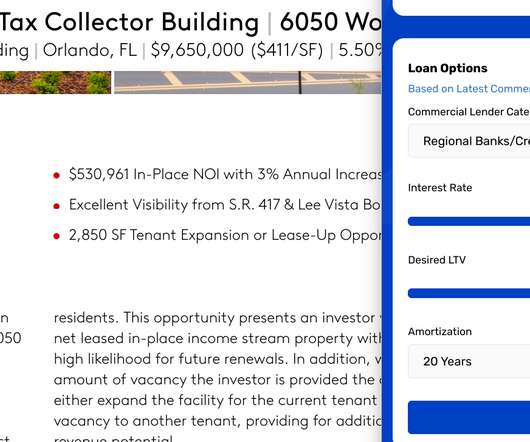

Firstly, they may lend it out, offering mortgages to individuals for home purchases or businesses for factory construction. The Federal Reserve has increased interest rates at its fastest pace in 40 years. Almost all commercial real estate properties have adjustable-rate mortgages.

Let's personalize your content