When do Credit Card Payments Report to Credit Bureaus?

The Red Spectrum

MAY 18, 2023

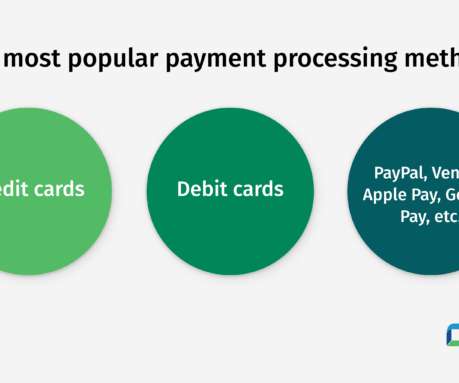

When it comes to managing your finances and building a healthy credit history, understanding how credit card payments affect your credit reports is essential. What Are Credit Bureaus? Before diving into the details, let’s first understand what credit bureaus are.

Let's personalize your content