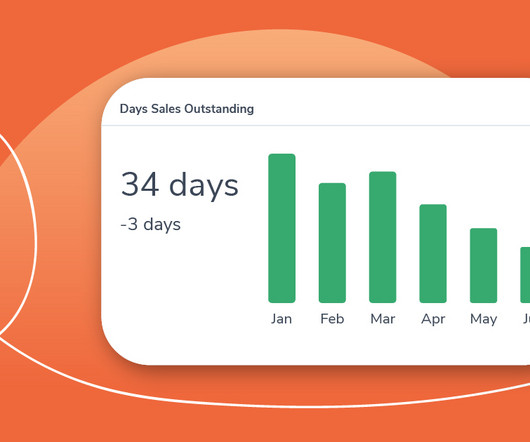

Moving Beyond DSO

Your Virtual Credit Manager

FEBRUARY 20, 2024

Financial Health Priorities: Organizations may have specific financial health priorities such as improving liquidity, managing working capital, or reducing credit risk. The experts at Your Virtual Credit Manager are ready to help you improve cash flow and reduce AR risks during these challenging times. Where do you need to improve?

Let's personalize your content