Develop a data-rich dashboard: Which medical billing metrics matter?

Waystar

APRIL 25, 2023

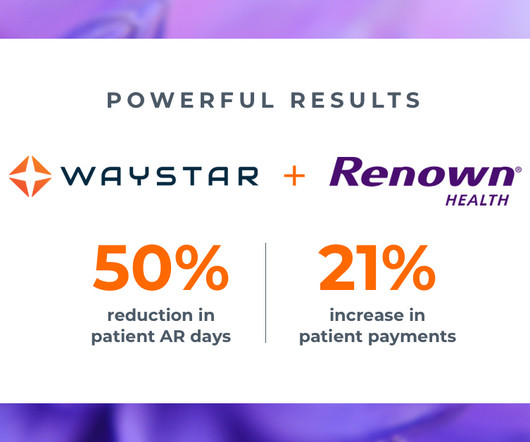

When you’re managing a rev cycle, medical billing metrics matter. Seasoned RCM pros know that a revenue cycle doesn’t end until you report on it, and that means using key performance indicators (KPIs). medical billing metriC: 2. Aged receivables are more costly to collect, and the probability of collection dips.

Let's personalize your content