Rethinking Receivables (Part 2): Why AI-Driven Automation Should Be Part of Any Long-Term Strategy

The Esker Blog

DECEMBER 29, 2022

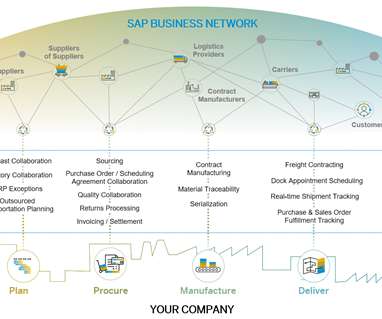

Fortunately, this is exactly what AR automation solutions provide: An easy-to-use, easy-to-implement solution that works by removing the manual bottlenecks throughout the invoice-to-cash (I2C) cycle that are responsible for slowing down cash collection, revenue securement, and, ultimately, your company’s ongoing growth and resiliency.

Let's personalize your content