Best Debt Collection Agency in India: MNS

MNS Credit Management Group

DECEMBER 2, 2022

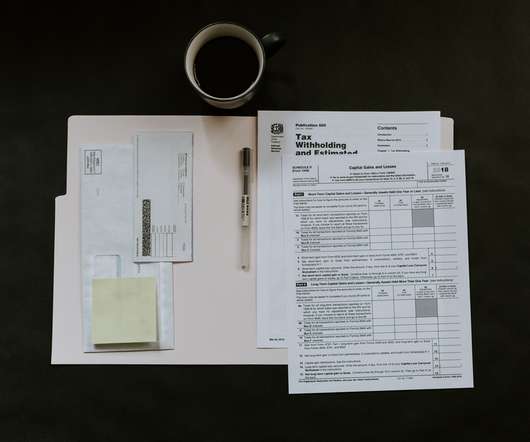

You also need to have this proof for your tax records if you plan to deduct the bad debt from your income. The IRS will seek proof that you looked into all possible options before declaring the debt as a deduction in the case of an audit. b) Paying less money while making deductions for poor quality, delayed shipping, etc.

Let's personalize your content