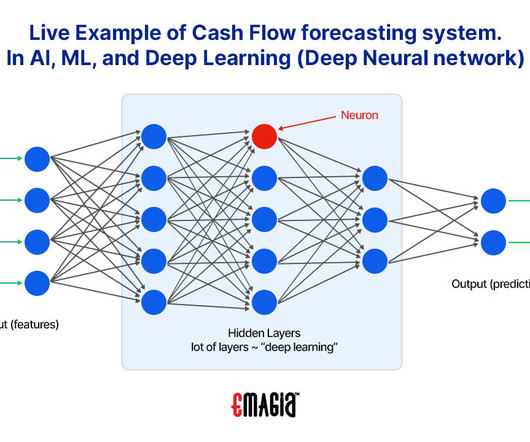

Put Your Cash Flow on Autopilot with Recurring Revenue

Your Virtual Credit Manager

DECEMBER 12, 2023

Recurring Revenue is derived from providing a continuous, ongoing service, such as a subscription, license, rent, or a maintenance contract. It is governed by a contract for a fixed period of time (often one year). If the contract is not cancelled, it can provide steady revenue and cash flow every month, year after year. Recurring revenue is sought by businesses and prized by Wall Street in its valuation of companies.

Let's personalize your content