Healthcare RCM: Here Come the Corporations!

RevCycle

JULY 20, 2022

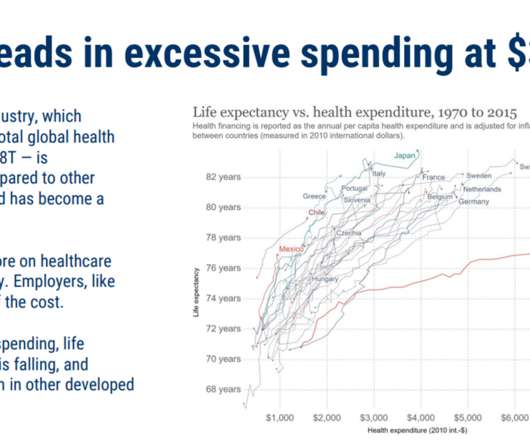

Make no mistake, the healthcare industry is rife for new entries across a wide span of verticals and corporate America has taken note. This is due to the cost burden crushing consumers and employers alike; and is a natural extension of the increased consumerism patients have been exhibiting for years. The image below does a great job highlighting just what makes the marketplace so appealing to the largest corporations: Image Source: CBINSIGHTS, “The Big Tech in H

Let's personalize your content