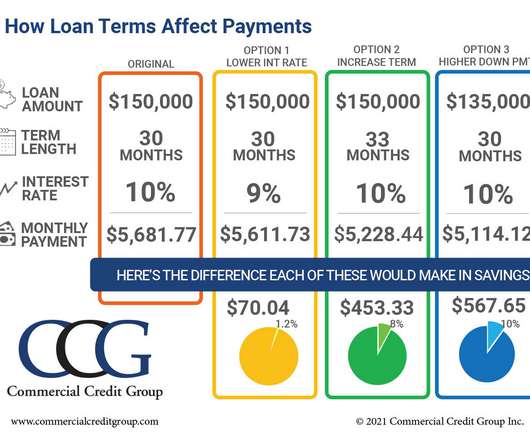

How Loan Terms Affect Payments

Commercial Credit Group

SEPTEMBER 2, 2021

When companies consider financing the purchase of a new or used piece of equipment, the monthly payment amount can be critical. In many cases, the target amount of the payment is determined based upon cash flow needs or what the business can afford.

Let's personalize your content