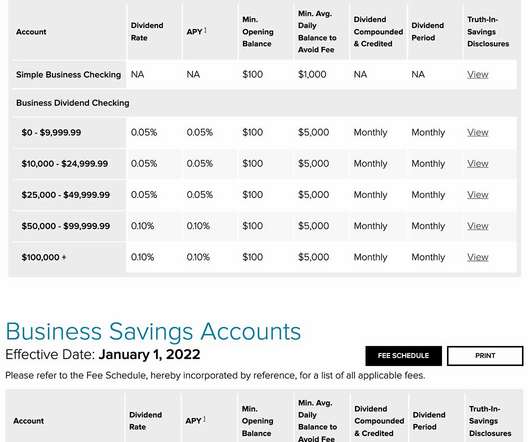

Coming Rate Hike Should Nudge Bankers to Focus on Deposit Management Strategy

Abrigo

JANUARY 27, 2022

Higher Fed Rates Ahead: Plan Now to Manage Impact on Deposits The Fed's signal of higher interest rates reiterates the importance of financial institution ALM and deposit management strategies, policies, and programs. . You might also like this webinar, "ALM Basics: Best Practices in Measuring, Monitoring and Controlling IRR" WATCH . Takeaway 1 Without proper ALM planning and deposit management, the expected Fed rate hike might not generate expected rewards. .

Let's personalize your content