Bad Actors Emerge in PPP Lending – More Expected as Forgiveness Guidance Emerges

Abrigo

MAY 15, 2020

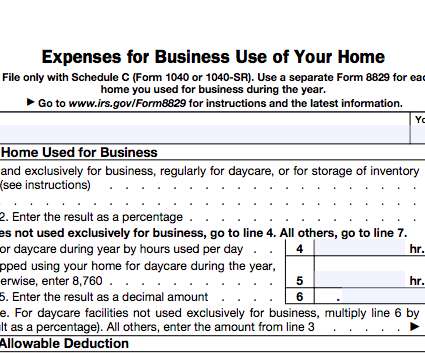

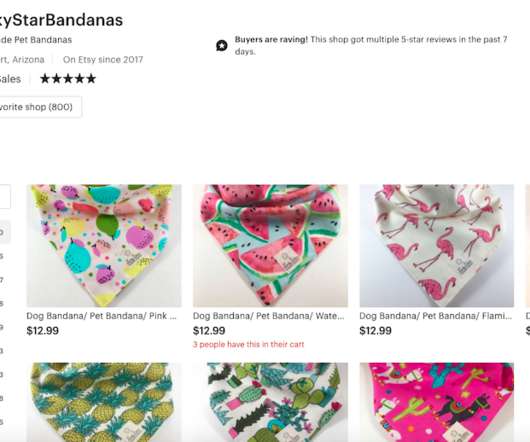

Key Takeaways Like other federal relief programs, the PPP has become subject to fraud. The first federal charges of PPP loan fraud have been made – and they're unlikely to be the last. While the SBA has said lenders will be held harmless, some banks fear they will still be culpable if borrowers fail to comply with PPP criteria. Banks can take additional steps to bolster customer due diligence.

Let's personalize your content