Are You Your Own Worst Enemy?

Your Virtual Credit Manager

OCTOBER 31, 2023

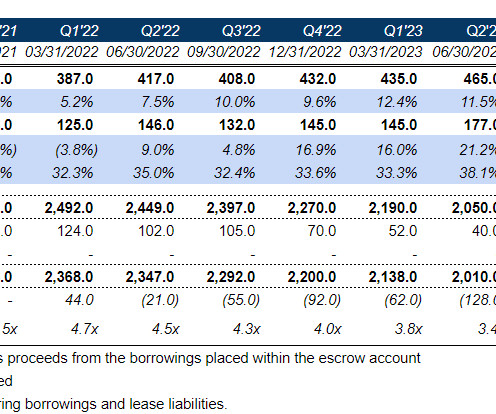

Accounts receivable (AR) represent the amounts owed your business by your customers for the purchase of goods or services delivered on credit. Because AR constitutes one of largest assets on your books, proactively managing accounts receivable is crucial for the financial health of your business. Especially in these times of high interest rates and economic uncertainty.

Let's personalize your content