Do You Know What's Going on with Your AR?

Your Virtual Credit Manager

NOVEMBER 22, 2022

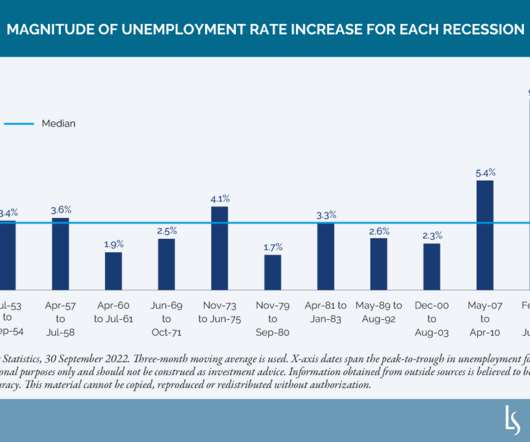

Photo by Erik Mclean on Unsplash As discussed in several prior newsletters, the threat of bad debt loss and diminished cash flow from delayed payments increases significantly during a recession. The reason is simple — most of your customers will be suffering lower sales volumes, discounted pricing, and their own cash flow shortages. This inevitably result… Read more.

Let's personalize your content