Your Financial Institution Issued a PPP Loan – Now What?

Abrigo

APRIL 15, 2020

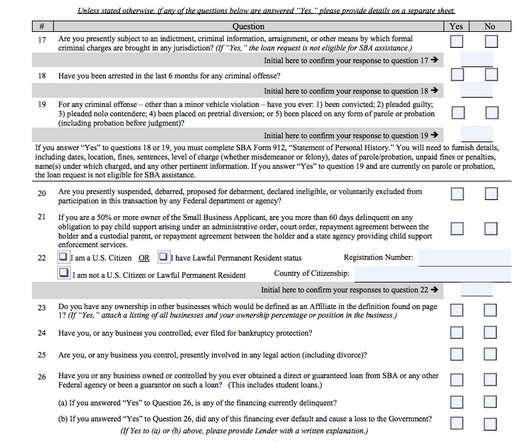

Key Takeaways Lenders participating in the Paycheck Protection Program (PPP) have obligations after issuing the loan to a small business. Banks and credit unions are seeking guidance on these critical next stages of the PPP. Lenders have had concerns about closing PPP loans, an action that triggers required funding and the forgiveness timeframe for borrowers.

Let's personalize your content