Gleaning Actionable Insights from Credit Scores

Your Virtual Credit Manager

APRIL 2, 2024

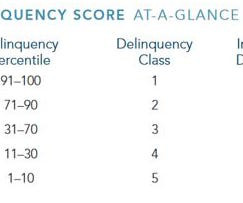

Commercial credit scores predict the likelihood of a business fulfilling its financial obligations, particularly regarding debt repayment and trade credit. Commercial credit scores are often not as well understood as consumer credit scores such as FICO. Photo by Element5 Digital on Unsplash First, a little background.

Let's personalize your content