How Do Small Business Owners Pay Themselves? The Quick and Simple Answer

Fundera

MAY 16, 2017

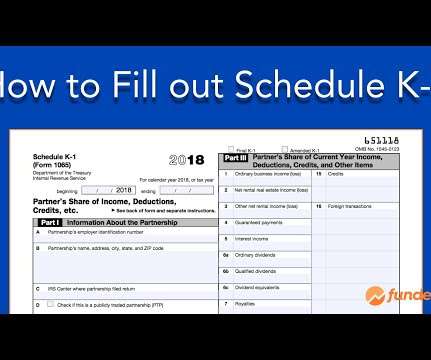

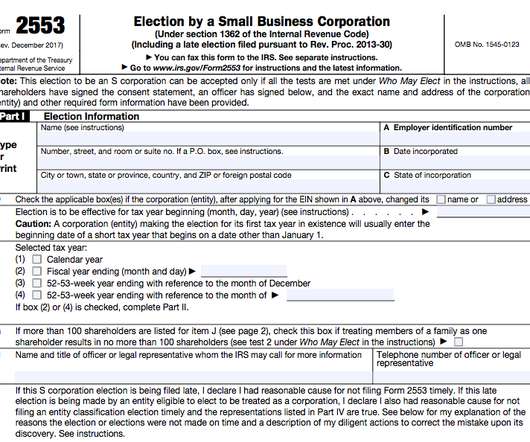

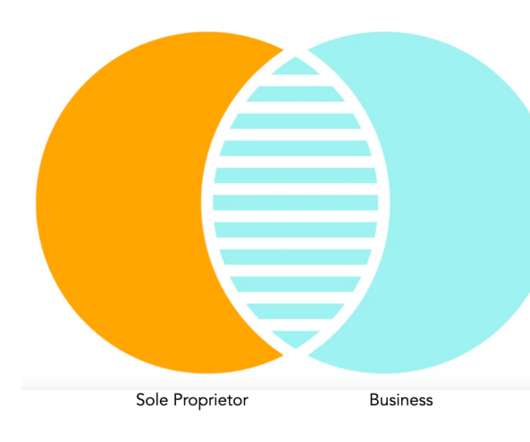

Sole proprietorships , partnerships, S corps , and C corps all have different rules about how their owners, members, or shareholders are paid—and taxed. S Corporations. S corp shareholders are typically also employees of the business. S corps require stricter controls than sole proprietorships.

Let's personalize your content