Unlocking Value in Bank Partnerships: A Roadmap for Success

Biz2X

OCTOBER 13, 2023

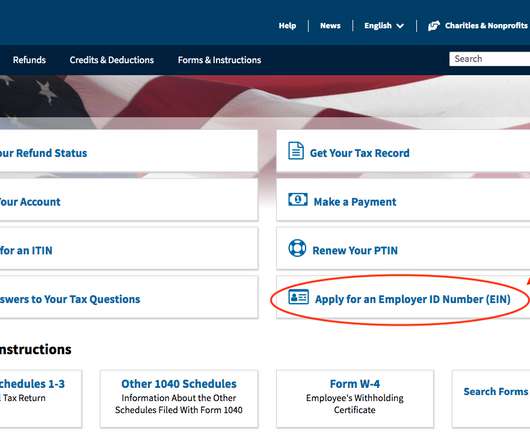

Concurrently, partnering companies expand their product offerings, enriching the value proposition for their existing and potential clientele. The salient values of such partnerships for financial institutions encompass: Enhanced Digital Offerings: Elevating the spectrum of digital products available to customers.

Let's personalize your content