Mastering your financial journey into retirement

Due

MAY 7, 2024

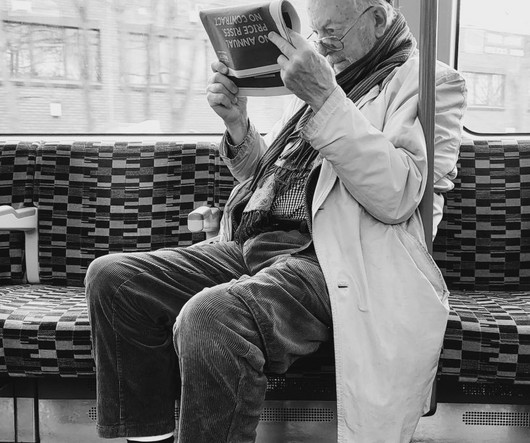

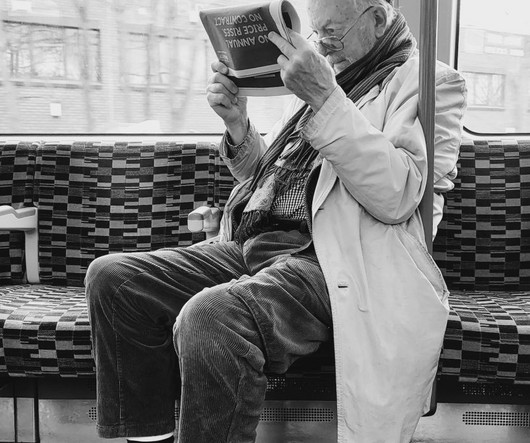

Retirement is a significant milestone in one’s life, marking the end of a long journey of work and the beginning of a new phase of relaxation and leisure. However, the transition to retirement is not always smooth, mainly regarding financial matters.

Let's personalize your content