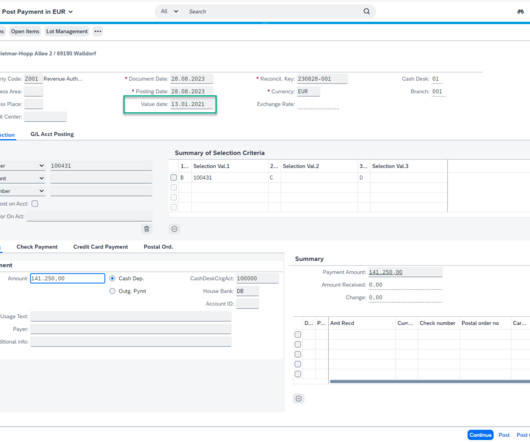

Interest and Penalty Simulation and Recalculation (predated payments) in SAP TRM/PSCD

SAP Credit Management

AUGUST 28, 2023

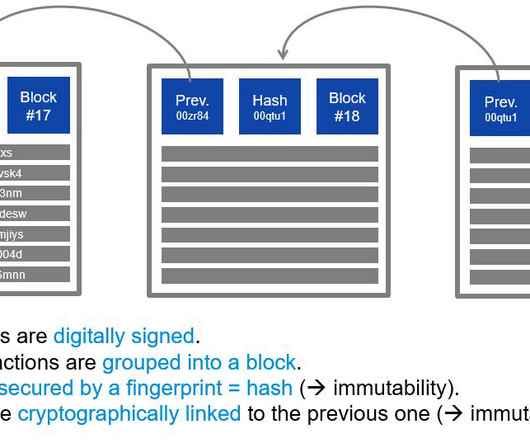

Interest Calculation Tax authorities may have to calculate and post credit/debit interests on payables/receivables. SAP PSCD provides the Interest Calculation feature to support the requirement. the due interest amount is only correct at the time when the last interest calculation run is executed.

Let's personalize your content