We Are Here: Thinking about Recession Risk

Loomis Sayles Credit Research

NOVEMBER 22, 2022

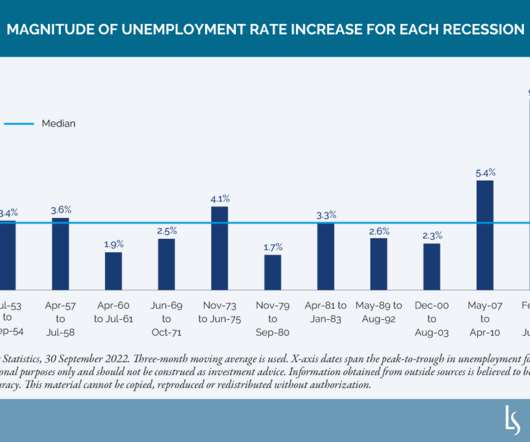

On the threshold of recession. Sad to say, we think the likelihood of a recession starting in 2023 is increasing. While the Federal Reserve has not explicitly forecast a recession, the unemployment rate projected in the Fed’s quarterly Survey of Economic Projections [i] is consistent with a recession forecast.

Let's personalize your content