Bad Debt Is Lurking in Your Accounts Receivables, but Where Is It?

Your Virtual Credit Manager

OCTOBER 3, 2023

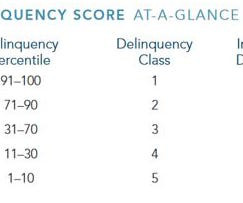

The typical course of action on managing bad debt loss is to identify, then focus credit and collection activities on individual customers who are financially weak. These customers pose the highest risk of bad debt loss. Share Customer Segments and Credit Risk Customer segments can be defined in many ways.

Let's personalize your content