So Where is the Economy Headed? A Review of Ryo Tashiro’s Presentation

Credit Research Foundation

FEBRUARY 8, 2024

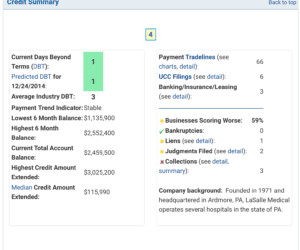

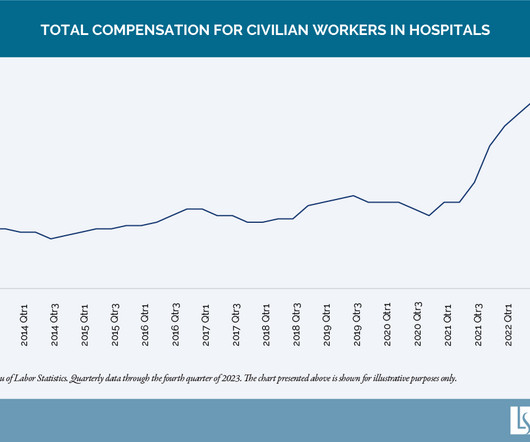

What is true is that bankruptcies are up and there is more risk in the economy than we have seen in the past several years. Here are several highlights as presented by Ryo: FRB, 3rd District Business Outlook – Both manufacturing and non-manufacturing business sectors are less optimistic about the future.

Let's personalize your content