Experian Business Credit Scores, Explained

tillful

JUNE 14, 2023

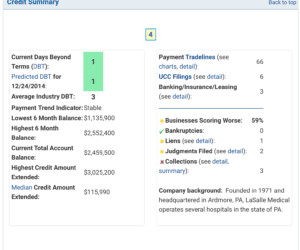

Looking to learn the ins and outs of Experian business credit scores ? as a consumer credit reporting company, but it also collects information on millions of businesses and provides business credit reporting services. You can download the Tillful iOS app to check if your company has a credit profile with Experian.

Let's personalize your content