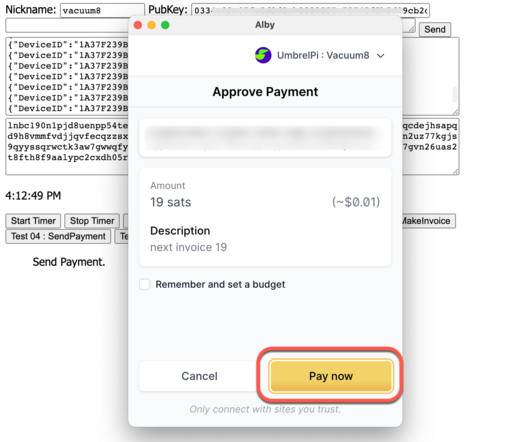

It’s Time to Send Invoices and Receive Payments Electronically

Your Virtual Credit Manager

MAY 30, 2023

Paper based commerce, where invoices and payments are delivered via Postal Service mail, is slow and costly. Increasingly, electronic payments are replacing checks in B2B scenarios. AFP’s 2022 Electronic Payments Survey revealed that only 33 percent of Business-to-Business (B2B) payments are made by check in the USA and Canada.

Let's personalize your content