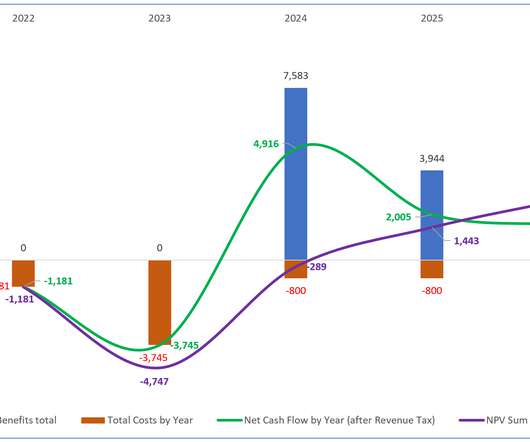

Value Management for the Chemical Companies (Part 4) – NPV & IRR Estimation

SAP Credit Management

JANUARY 22, 2023

Reference That is Part 4 of the blog article series I would like to describe the Value Management Approach for Chemical companies. In previous Part # 3 I explained the common approach of the estimation of the expected benefits value, and the high-level definition of the transformation roadmap based on previous analysis.

Let's personalize your content