In low-code projects, governance is nothing to be afraid of!

SAP Credit Management

SEPTEMBER 15, 2023

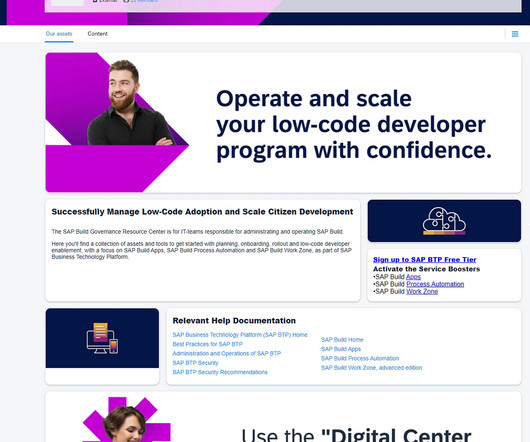

Almost a year ago, at SAP TechEd 2022, we launched SAP Build, our low-code/no-code portfolio on SAP Business Technology Platform. Low-code and no-code tools can make it easy to skip important safeguarding procedures during production, which can lead to errors and security risks ”. What is a Low-code Governance Model?

Let's personalize your content