How to Import Bank Transactions Into QuickBooks Online

Fundera

APRIL 23, 2020

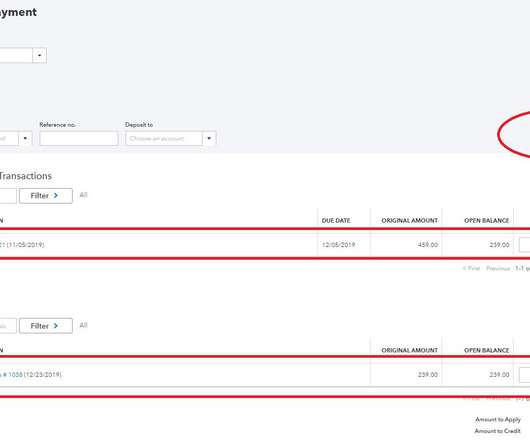

One of the most popular of these features is the ability to import bank and credit card transactions directly into QuickBooks Online. On the surface, importing bank transactions into QuickBooks Online seems easy. But there are some limitations and challenges that can arise when importing transactions into QuickBooks Online.

Let's personalize your content